Its too easy these days to analyze data and forecast things using the power of cloud, all the machine learning it provides and what not. I asked the team to create a forecast model on S&P, just for fun to see the results using the cloud tools we have.

First stage was analyzing. I think the time period for recovery of the S&P has become shorter as the time has progressed and I wanted to get that validated.

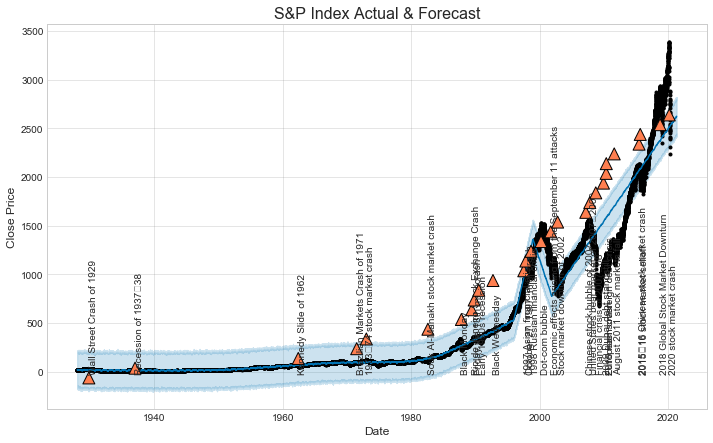

This historical 100 year trend shows that the time period for the market to recover is getting shorter as the governments have better tools to manage and recover the economy.

As you look at the last 20 years, you can see it even clearer.

The same trending on the last 2 years. All S&P index numbers are plain and not inflation adjusted.

Here is a forecast which even considers somewhat the events that happened in the past.

a 100 year view

20 year view

And a 2 year view.

I am not debating that this model is accurate, this may work, may not work. But the power of the cloud is just immense and what used to take months and years is now done in hours. This was literally done in a matter of hours.

Cloud provides so many models which have been tested in the different scenarios and are ready to consume and do what the needful is. To take benefit of the tools cloud provides contact us.. info@digitalglyde.com

https://waterfallmagazine.com

What’s up, every time i used to check web site posts here early in the morning, since

i enjoy to learn more and more.